The complete solution for sustainability management

We simplify and streamline ESG data collection, measurement, reporting, and analysis, so you can spend more time driving sustainable impact.

Spend less time, get more done

With all your ESG data in one place, you can instantly generate reports, dive into performance metrics, and make data-driven decisions.

Be confident in your data

Capture audit trails and automate data collection to reduce manual errors and increase transparency. Trust your numbers to stand up to the highest level of scrutiny.

Keep up with changing requirements

Adapt swiftly to evolving regulations and standards with proactive tracking and updating. Stay current, compliant, and ahead of the curve.

Take the pain out of managing your sustainability program

Transform the way you manage your sustainability and ESG processes. We handle the hard parts for you.

COLLECT

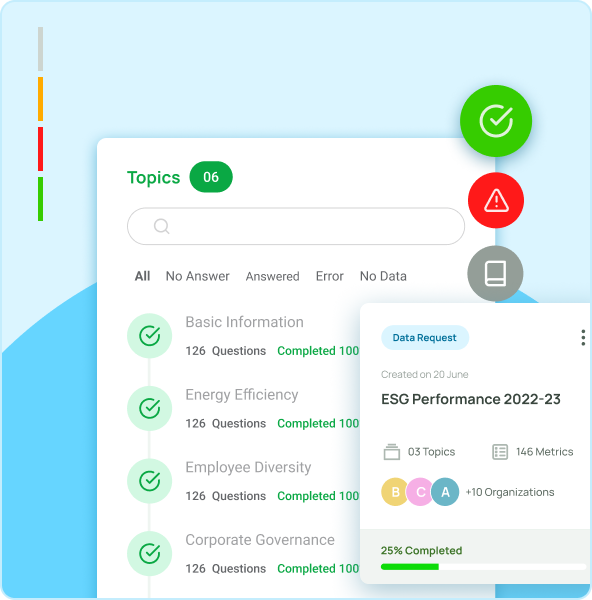

Streamline data collection

Ditch the clunky spreadsheets, endless emails, and manual data entry. Get all your sustainability and ESG metrics in one place, effortlessly.

Integrate your data sources

Seamlessly integrate with your existing business systems. Bring in data from 230+ applications, or upload files in a variety of flexible formats.

Automate your data requests

No more chasing down colleagues and partners about past-due submissions or inaccurate inputs. Pulsora’s structured workflows make it easy to scale data requests, identify errors, and streamline approvals.

A single source of truth

Spend less time sifting through spreadsheets. No matter where it’s from or what it’s for, all your sustainability and ESG data is in one place.

MEASURE

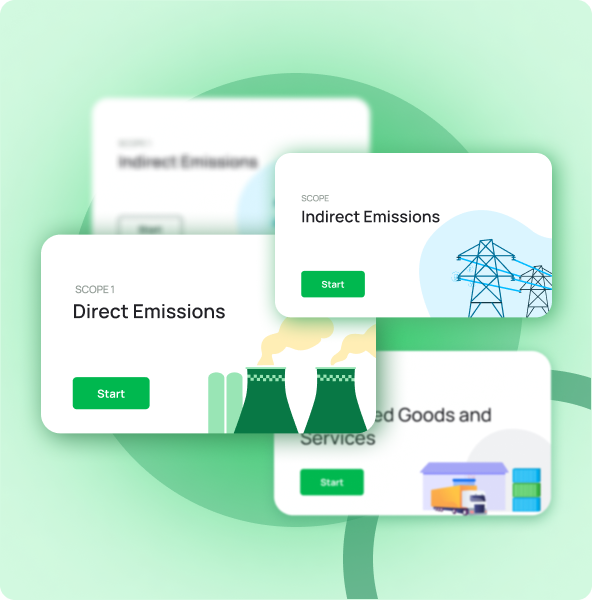

Map your carbon footprint

Seamlessly measure, manage, and mitigate emissions across all scopes to power a more sustainable future.

Delve into detailed carbon data

Dive into emissions data with pinpoint precision, from location-based specifics to individual facilities or buildings. Make informed decisions with the nuance you need.

Tailor your emission factors

Choose from established emission factors provided by IEA, UK DEFRA, US EPA, and others. Or, customize your calculations with unique factors to fit your specific needs.

Comprehensive emission accounting

Employ user-friendly calculators to measure emissions across Scopes 1, 2, and 3, ensuring accuracy and ease in every calculation.

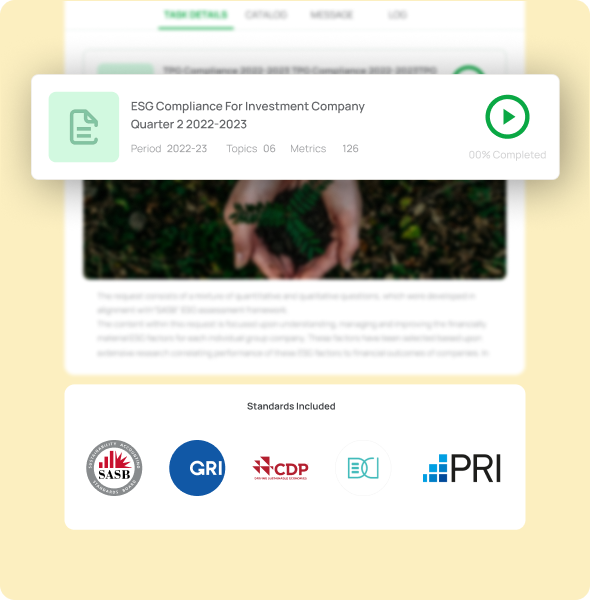

REPORT

Prepare and file ESG disclosures with confidence

Simplify regulatory reporting, respond rapidly, and stay audit-ready with Pulsora.

Build reports, fast

Generate high-quality disclosures that meet reporting requirements from CSRD, CDP, EDCI, and more, with just a single click.

Create tailored responses

Respond to ad hoc requests quickly and accurately. Create and track custom metrics, drill down into specific data points, and build bespoke reports for any stakeholder.

Ace any audit

Rest assured with Pulsora. Know where your data comes from, track who made changes and when, and provide supporting evidence for each metric.

ANALYZE

Dive deeper into your sustainability data

Translate your ESG metrics into actionable strategies and performance benchmarks.

Get visibility into your data

See and explore your ESG and carbon data with custom dashboards. Easily access, filter, and visualize data to make better decisions, faster.

Set targets and track progress

Use predictive analytics to model different targets and outcomes, then choose the right goals and action plans for your business.

Benchmark your performance

Put your sustainability program in context. Compare your performance against industry standards such as Refinitiv, CDP, SMSCI, Sustainalytics, and more.

Built for enterprise scale

Secure and compliant

Pulsora is SOC 2 Type 2 compliant. We take extra steps to anonymize, encrypt, and safeguard your data.

Endlessly adaptable

Easily configure to fit your evolving needs, ensuring agility in achieving goals while driving performance.

Collaboration at scale

Empower your partners and affiliates to manage their ESG performance data with unlimited users.

Make sustainability and ESG your competitive advantage

Get a personalized demo with one of our sustainability policy and compliance experts.